-

Phone Banking Services Customer Identity Authentication Process

Phone Banking Services Customer Identity Authentication Process

- Personal

- Corporate

- Ambassador Banking

- Greater Bay Area Banking

- eticketing

- Deposit

- Loans

- Cards

- Insurance

- Investment

- Securities

- Fixed Deposit

- magi©money manager Interest-bearing Current Account

- Statement Savings Account

- Target Savings Plan

- RMB Services

- Latest Promotions

- Money Safe Protection Service

- magi©money manager HKD Interest-bearing Current Account

- magi©money manager RMB Interest-bearing Current Account

- magi©money manager USD Interest-bearing Current Account

- Fubon+ Foreign Currency Fixed Deposit Promotion

- Foreign Currency Fixed Deposit Promotion

- Fixed Deposit Promotion

- Fubon Bank Account Opening Welcome Offers

-

Personal Loan

-

Mortgage Loan

- Fubon Mortgage Services Overview

- Fubon Preferential Mortgage Plan

- Fubon 90% Mortgage Plan

- Fubon HIBOR Mortgage Plan

- Fubon Mortgage Plan for Government Home Ownership Scheme

- Fubon Incoming Talents Mortgage Plan

- Fubon Reverse Mortgage Plan

- Monthly Mortgage Repayment Calculator

- Fubon Mortgage Loan Referral Plan

- Residential Properties Refinancing via the PAPT Payment Arrangement

- Sales and Purchase of Residential Properties in 2nd Market via the PAPT Payment Arrangement

- Forms & Terms

- Fubon Mortgage Services Overview

- Fubon Preferential Mortgage Plan

- Fubon 90% Mortgage Plan

- Fubon HIBOR Mortgage Plan

- Fubon Mortgage Plan for Government Home Ownership Scheme

- Fubon Incoming Talents Mortgage Plan

- Fubon Reverse Mortgage Plan

- Monthly Mortgage Repayment Calculator

- Fubon Mortgage Loan Referral Plan

- Residential Properties Refinancing via the PAPT Payment Arrangement

- Sales and Purchase of Residential Properties in 2nd Market via the PAPT Payment Arrangement

- Credit Cards Application

-

Latest Local Promotions

- Chinachem Group Shopping Mall

- Fubon Visa Credit Card x Apple Pay Promotion

- OpenRice

- Adventist Medical Center

- Arts Optical / Eye Pick Express

- Assure Medical Imaging

- CAFEMCM

- DCH Mobility

- EVA AIR

- Gilman

- H16 Medical Tower

- Hang Heung

- Lao Chuan Huang Sichuan Restaurant

- INNOTIER

- King Fook Jewellery

- Le Méridien Hong Kong, Cyberport

- Lukfook Jewellery

- On Kee Dry Sea Food

- Pricerite 實惠

- RentSmart

- Robot Institution of Hong Kong

- TEA CHÂTEAU

- The Fullerton Ocean Park Hotel Hong Kong

- Ting House

- Wan Kee

- Latest Overseas Promotions

- Credit Card Privileges

- Credit Card Exclusive Priority Booking

- Interest-free Cash Installment Plan

- Fubon Credit Card Paper Statement Fee

- Other Services

- Forms and Terms

- Other Useful Information

- Fubon Visa Infinite Card

- Fubon iN VISA Platinum Card

- Fubon Visa Platinum Card

- Fubon YATA Visa Platinum Card

- Chinachem Group Shopping Mall

- Fubon Visa Credit Card x Apple Pay Promotion

- OpenRice

- Adventist Medical Center

- Arts Optical / Eye Pick Express

- Assure Medical Imaging

- CAFEMCM

- DCH Mobility

- EVA AIR

- Gilman

- H16 Medical Tower

- Hang Heung

- Lao Chuan Huang Sichuan Restaurant

- INNOTIER

- King Fook Jewellery

- Le Méridien Hong Kong, Cyberport

- Lukfook Jewellery

- On Kee Dry Sea Food

- Pricerite 實惠

- RentSmart

- Robot Institution of Hong Kong

- TEA CHÂTEAU

- The Fullerton Ocean Park Hotel Hong Kong

- Ting House

- Wan Kee

- TANZUOMALI

- TANGO MALA

- MONGOBEEF SUKIYAKI

- LITTLE MONGOLIAN

- HANOKTOFU

- DUBU HOUSE KOREA

- NU PASTA

- TIAN LI

- Bonus Points, Overseas Transactions Rewards and Upgrade Rewards Program

- Sure Win Spending Rewards

- 8X points for travel insurance plans

- Rewards Redemption

- Cash Advance Reward Program

- Any-can-do Purchase Installment Plan

- Interest-free Installment Loan Plan

- Octopus Automatic Add-Value Service Octopus Automatic Add-Value Service

- Credit Card Payment Method

- Online Calculators

- Apple Pay

- Google Pay

-

Life Insurance

- Treasure Elite Insurance Plan

- Wealth Leisure Multi-Currency Insurance Plan

- Joyful Legend Insurance Plan

- Wise Legend Multi-Currency Insurance Plan (Excel)

- Fortune Smart Protector

- Forest Insurance Plan (2)

- Forest Insurance Plan (5)

- Reach Insurance Plan

- Fortune Income Creator

- Vertex Insurance Plan (Single Pay)

- Wealth Elite Saver 3 – Golden Years

- Fubon Wealth Management Products Financing

- General Insurance

- Prescribed Levy to Insurance Authority

- Treasure Elite Insurance Plan

- Wealth Leisure Multi-Currency Insurance Plan

- Joyful Legend Insurance Plan

- Wise Legend Multi-Currency Insurance Plan (Excel)

- Fortune Smart Protector

- Forest Insurance Plan (2)

- Forest Insurance Plan (5)

- Reach Insurance Plan

- Fortune Income Creator

- Vertex Insurance Plan (Single Pay)

- Wealth Elite Saver 3 – Golden Years

-

Personal Insurance

- MyWay Travel Insurance Plan

- Get “Z” Go+ Travel Insurance Plan

- Fubon Personal Accident Insurance Plan

- FortuneSafe Home Insurance

- Landlord Protector Insurance

- Fubon Home Plus Insurance Plan – Householder Insurance

- HomeChoice Insurance Plan – Landlord Insurance

- HomeHelperPlus Insurance Plan

- HelperSurance 4.0

- Private Motor Car Insurance

- Commercial Insurance

- Latest Promotions

- Wealth Management Services

- Global Market Commentary

- Investment Fund Services

- Currency-Linked Deposit

- Bond Investment Services

- Derivative Knowledge Centre

- Product Risk Rating and Customer Risk Profile

- Enjoy extra 18.88% / 12.88% p.a. interest rate for 1 week by Subscription of Relevant Investment Products

- Enjoy up to total HK$13,888 Cash Reward in your First Subscription of Relevant Investment Products (Mar 2026)

- Investment Fund Transfer-In Cash Reward Offer

- Investment Fund Services

- Fund Search

- Fubon Wealth Management Products Financing

- FB Invest+ Stock Trading Service

- SMS-OTP for 2-Factor Authentication

-

Stocks Trading

- Shanghai Connect / Shenzhen Connect

- IPO Subscription / IPO Margin Financing

- Share Margin Services

- Corporate Account Opening

- General Corporate Loan

- Trade Finance

- China Business

- SME Banking

- Fubon Credit Card Merchant Services

- Fubon Online Payment Service

- Professional Banking Services

- Diversified Banking Products

- Exclusive Privileges

- Latest Promotion

- Cross-boundary Wealth Management Connect (Southbound Scheme)

- eTicketing Service

-

Online Services

- Internet Banking Service

- Mobile Banking

- Fubon GO Service (Individual Customer)

- Fubon GO Service (Corporate Customer)

- Internet Stock Trading Service & FB Invest+

- Latest Offers

- Fubon Faster Payment System (FPS)

- Fubon Mobile Security Key Service

- e-Statement and e-Advice Service

- Online Foreign Currency Exchange Service

- Open Banking

- e-Cheque Service

- Fubon Business Online

- Credit Card Merchant Online

- About Us

- Contact Us

- Application

- Service Outlets

- System Maintenance Schedule

- Internet Banking Service

- Mobile Banking

- Fubon GO Service (Individual Customer)

- Fubon GO Service (Corporate Customer)

- Internet Stock Trading Service & FB Invest+

- Latest Offers

- Fubon Faster Payment System (FPS)

- Fubon Mobile Security Key Service

- e-Statement and e-Advice Service

- Online Foreign Currency Exchange Service

- Open Banking

- e-Cheque Service

- Fubon Business Online

- Credit Card Merchant Online

- Login Fubon Internet Banking Service

- Fubon Internet Banking Service Overview

- eBill Payment - Merchant List

- One Time Password Service

- Important Message

- Starter Kit

- Fubon Internet Banking Service Demo

- FAQ

- Privacy Policy

- General

- Transaction

- Browser

- Trouble Shooting

- Technical

- Security

- One Time Password

- Fubon+ Service Overview

- Fubon Mobile Apps Security Tips

- Fubon+ Starter Kit

- Fubon+ FAQ

- Fubon Mobile Banking Terms and Conditions

- Fubon+ Demo Video

- Starter Kit (Cash Order)

- Starter Kit (Cheque Book)

- Starter Kit (Demand Draft)

- Fubon GO Service Overview

- Fubon GO Starter Kit

- Fubon GO FAQ

- Fubon GO Service Terms and Conditions

- Fubon GO Starter Kit

- Fubon GO FAQ

- Fubon GO Service Terms and Conditions

- Service Overview

- Service Demo

- FAQ

- Security Tips

- Fubon FPS Service Overview

- Fubon FPS Starter Kit

- Fubon FPS FAQ

- Fubon Mobile Security Key Service Overview

- Fubon Mobile Security Key Service FAQ

- Fubon Mobile Security Key Service Terms and Conditions

- Fubon e-Statement and e-Advice Service Overview

- Fubon e-Statement and e-Advice Terms and Conditions

- Open API and Interbank Account Data Sharing (IADS) Scheme

- FAQ

- Security Tips

- Application Form

- Fubon e-Cheque Service Overview

- Fubon e-Cheque Service Terms and Conditions

- Fubon Business Online Service Overview

- Security Tips

- Starter Kit

- FAQ

- Service Charges

- Privacy Policy

- Privacy & Disclaimer Statements

- Fubon Business Online Terms and Conditions for Accounts and Services

- Application Form

- Browser

- Trouble Shooting

- Technical

- Security

- Login Credit Card Merchant Online

- Security Tips

- Starter Kit

- Credit Card Merchant Online Demo

- Credit Card Merchant Online FAQ

- Privacy & Disclaimer Statements

- Privacy Policy Statement

- Corporate Profile

- Key Milestones, Awards & Recognitions

- Board of Directors

- Senior Management

- Press Release

- Corporate Governance

- Investor Relations

- Sustainability

- Core Values of Fubon Financial Holdings

- Careers

- Financial Information

- Regulatory Disclosures

- Corporate Announcements

- Fubon Financial Announcements

- Fubon Credit Announcements

- Credit Ratings

- Shareholders' Meeting

- Contact Investor Relations

- Electronic Form

- Forms Download

- Your Own Financial Edge

- Online Calculators

- HK$10,000 Cash Payout Scheme

- Phone Banking Service

- Phone Banking User Guide

- Terms & Conditions for the Phone Banking Service

- Fubon Credit Card Any-can-do Purchase Installment Plan Calculator

- Fubon Credit Card Balance Repayment Calculator

- Funbon Personal Instalment Loan Repayment Schedule

- Monthly Mortgage Repayment Calculator

| (1) Customer Authentication Process for Phone Banking Services |

In order to enhance the security of our Phone Banking Services, cardholder is required to use Telephone Banking Identification Number (“TIN”) for customer identity authentication when performing account enquires or related transaction via Phone Banking Services. Please note that each cardholder (including both principal and supplementary cardholders) will only require to use one TIN to operate or access our Phone Banking Services for using all our bank’s products applicable to Phone Banking Services.

If you do not possess or cannot input the correct TIN for identity authentication, you may not be able to perform account enquiries or transactions through Phone Banking Services for all related bank products (including credit card account service and bonus point redemption service).

| (2) Application for TIN |

Cardholder can apply for TIN by the following ways. The TIN mailer will be sent to you by mail after we have confirmed your TIN application.

| 1) | Application by Phone* |

| Cardholder can call Fubon Bank Integrated Customer Service Hotline at 2566 8181 (press “1” and “9” after language selection) to apply for TIN. Cardholder is required to use any of his/her valid credit cards under his/her name which must be registered with a local mobile phone number for the application of TIN, otherwise, cardholder will need to visit any of our branches for TIN application. | |

| 2) | Application at Branch |

| Cardholder can visit any of our braches for TIN application during the business hours. For details, please click onto the Bank’s website. |

*If Cardholder has updated correspondence address at our Bank’s record in the past 3 months, cardholder is required to apply for TIN at branch.

| Frequently Asked Questions |

-

1) How can I apply for Telephone Banking Identification Number (“TIN”)?

- You can apply for TIN via Fubon Bank Integrated Customer Service Hotline at 2566 8181 (Press “1” > “9” after language selection) (for first-time application only) or by visiting any of our branches.

-

2) Do I need to apply for more TINs if I have more than one Fubon credit card?

- You will require just one TIN to access all of your credit card accounts under Fubon Bank for the Phone Banking Services. You do not need to apply for TIN for more than one time.

-

3) Do I need to apply for a new TIN if I am a Fubon bank account holder and am already using its Phone Banking Services?

- If you are a single name account holder of Fubon bank account and possess one TIN only, you can use your existing TIN for the Phone Banking Services and do not need to apply again. If you are a joint name bank account holder or possess more than one TIN, you will be required to apply for a new TIN.

-

4) I am not sure whether I need to apply for TIN. What can I do?

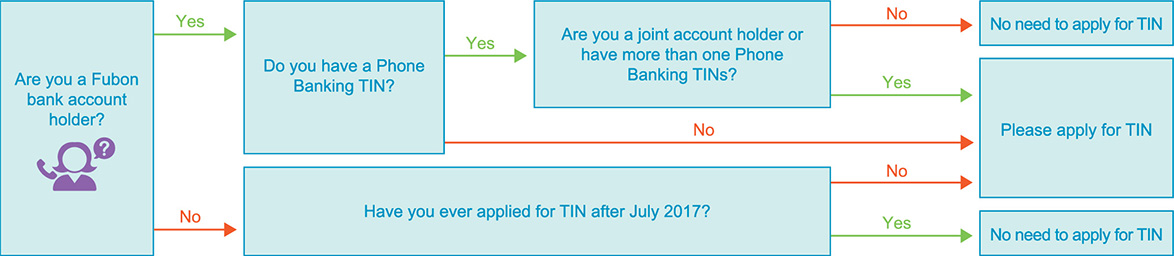

- Please read below flowchart to confirm whether TIN application is required for your case.

-

5) Can I apply for TIN again if I have already applied for it once?

- TIN application via Fubon Bank Integrated Customer Service Hotline is available for the first time application only. If you have forgotten the TIN or need to regenerate TIN, you will need to visit any of our branches to complete the TIN regeneration process.

-

6) Can supplementary cardholder apply for TIN?

- Supplementary cardholder can apply for TIN for account enquiry and related transactions of Supplementary card account via customer service representatives.

-

7) Can I change my TIN?

- Yes, you can change your TIN through Phone Banking Services.

-

8) What can I do if I forgot the TIN?

- Please visit any of our branches for TIN regeneration if you forgot the TIN.

-

9) What can I do if I would like to update my mobile phone number?

- You can complete and return to us the “Change of Customer Information and Choice of Receiving Direct Marketing Form”, which can be downloaded from our website at http://www.fubonbank.com.hk. Once the mobile phone number is updated in the Bank’s record, you can apply TIN via Fubon Bank Integrated Customer Service Hotline, or you can visit any of our branches for TIN application.

Sitemap

HOME

Personal

Deposit

Fixed Deposit

magi©money manager Interest-bearing Current Account

Statement Savings Account

Target Savings Plan

RMB Services

Latest Promotions

Money Safe Protection Service

Cards

Credit Cards Application

Latest Local Promotions

Latest Overseas Promotions

Credit Card Privileges

Credit Card Exclusive Priority Booking

Interest-free Cash Installment Plan

Fubon Credit Card Paper Statement Fee

Other Services

Forms and Terms

Other Useful Information

Insurance

Life Insurance

Fubon Wealth Management Products Financing

General Insurance

Prescribed Levy to Insurance Authority

Investment

Latest Promotions

Wealth Management Services

Global Market Commentary

Investment Fund Services

Currency-Linked Deposit

Bond Investment Services

Derivative Knowledge Centre

Product Risk Rating and Customer Risk Profile

Securities

FB Invest+ Stock Trading Service

SMS-OTP for 2-Factor Authentication

Stocks Trading

Shanghai Connect / Shenzhen Connect

IPO Subscription / IPO Margin Financing

Share Margin Services

Corporate

Ambassador Banking

Greater Bay Area Banking

eticketing

Important Message | Fubon Mobile Apps Security Tips | Careers | Rates Enquiry | Calculator | Service Charges | Key Facts Statement | Investor Relations | Regulatory Disclosures | Relating to the Personal Data (Privacy) Ordinance and Consumer Credit Data | Privacy Policy Statement | Privacy Impact Assessment | Global Terms and Conditions for Accounts and Services | Customer Due Diligence (CDD) Information | Anti-Bribery and Corruption Statement | Requirement for declaring excessive TWD (Chinese version only) | Common Reporting Standard | Code of Conduct and Practice | Understanding Dormant Accounts & Deceased Accounts | Web Accessibility Statement | Whistle Blowing

Member of Fubon Financial Holding Co., Ltd.

© Fubon Bank (Hong Kong) Limited . All Rights Reserved.